In today’s rapidly shifting regulatory landscape, both supervisors and financial institutions need more than fragmented insights – they need a clear, consolidated view of their risks.

That’s where ORBS, developed by AML Analytics, comes in. AML Analytics is a world leader in AML/CFT system testing and validation, trusted by some of the largest banks, regulators and governments across the globe. Building on this unrivalled experience, ORBS provides regulators and financial institutions with a powerful new way to understand, measure and strengthen risk management.

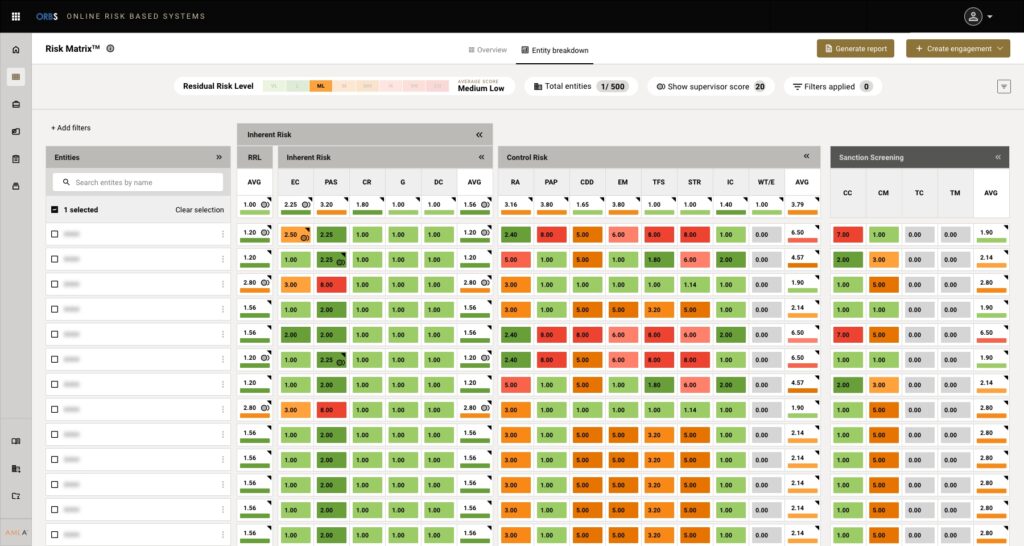

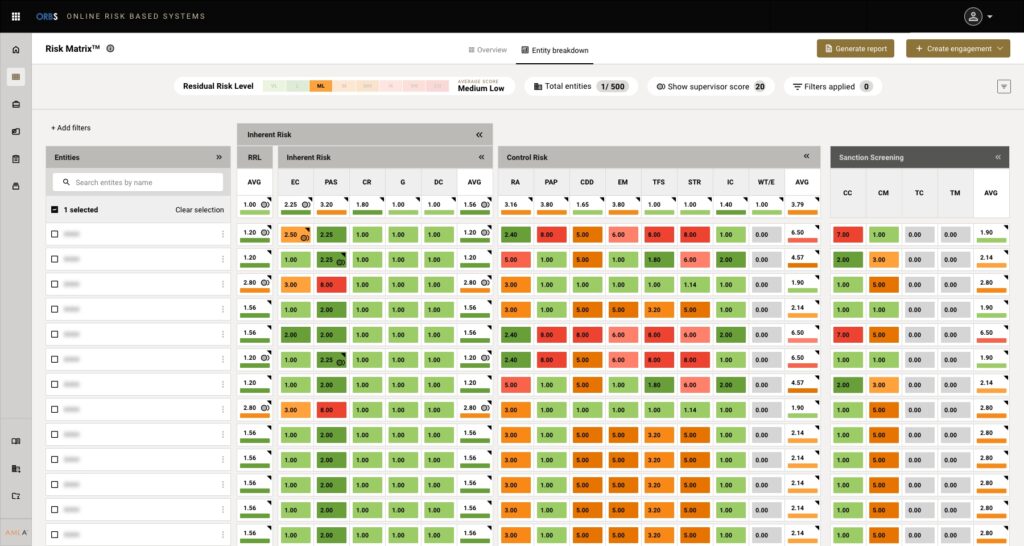

At the heart of the platform is the Risk Matrix, a dynamic view that maps and compares the relative AML/CFT risk across jurisdictions. This gives supervisors and regulators a clear picture of where vulnerabilities lie, how risks are evolving and where oversight resources should be prioritised. With the Risk Matrix, risk isn’t just measured, it’s visualised, benchmarked and prioritised.

By offering oversight of jurisdictional risk, enabling a deeper understanding of AML/CFT effectiveness and supporting efforts to raise supervisory standards, ORBS empowers decision-makers to move beyond surface-level reporting. Instead, they gain meaningful, actionable insights that ensure resources are deployed where they are needed most, compliance is evidenced with confidence and financial systems are made more resilient against financial crime.

This holistic approach has already been recognised internationally – ORBS was named the Best Risk Management Initiative at the Central Banking Awards last year.

As global expectations for AML/CFT effectiveness continue to rise, smarter analytics are no longer optional – they’re essential. ORBS ensures that teams aren’t just keeping pace with regulatory change but are setting new benchmarks for transparency, accountability and efficiency in risk management.

Find out how ORBS is helping organisations worldwide achieve better outcomes: Get in touch.