Optimising the entire risk life cycle

ORBS is changing the way financial institutions

approach risk

ORBS is a breakthrough in risk analytics for smarter, faster, more intuitive analysis, reporting and understanding of risk. The solution facilitates full clarity of risk status for financial institutions with a wide geographical spread.

ORBS ensures that inherent vulnerabilities across all geographies are identified and supports the appropriate application of mitigating controls for improved risk management across the business.

Large financial institutions harness the jurisdictional oversight capabilities ORBS has to offer. The solution facilitates the seamless assigning of in-depth risk assessment questionnaires for an EWRA across all geographies. It tracks the stages of completion by all parties - previously a resource-heavy and laborious task.

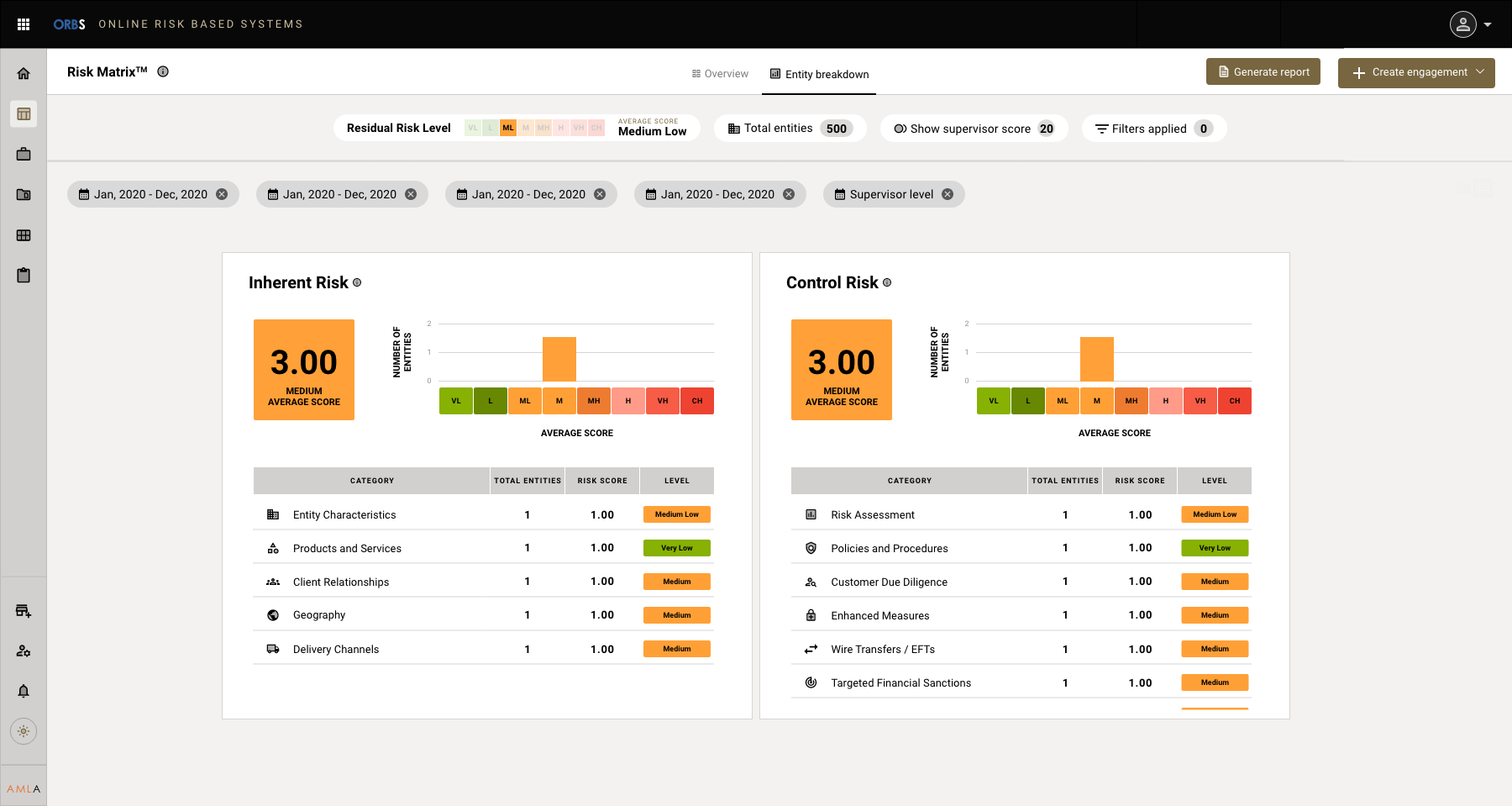

the orbs risk matrix

The ultimate consolidated

risk analysis screen

Risk data from risk assessment questionnaires and other sources flow into ORBS and the solution presents risk scores on a single screen in the ORBS Risk Matrix. This ensures optimum oversight, understanding and decision making.

The ORBS Risk Matrix provides an overall residual risk score as well as a detailed breakdown of specific risk for each entity in scope. It presents clear indications of risk so that a supervisory authority can make data-informed decisions concerning any necessary remediation steps.

ORBS powers the entire risk life cycle from sanctions screening system testing and quantitative risk assessment, all the way through to remediation, training and education.

REAL-TIME MARKET RISK INTELLIGENCE

Never-seen-before levels of transparency for improved reporting and supervision

ORBS enables entities around the globe to report to their head office through APIs so that management teams can see live dashboards of their entire jurisdictional risk in real time. This is live intelligence reporting where ORBS facilitates better communication, better internal reporting, better use of precious resource and better decision making at board level.

trust through transparency

Powerful reporting

of risk scores

ORBS facilitates trust through transparency, driving the upwards reporting of risk scores from entity to head office.

Entities also benefit greatly from the powerful reporting capabilities of ORBS. Any risk score improvements are visible to head office in ORBS for full transparency, alerting authorities that appropriate action is being taken where needed by reporting subsidiaries and regional offices.

ORBS has already been recognised by financial institutions, regulatory authorities, supervisors, central banks and governments around the globe as a breakthrough in risk analytics for smarter, faster, more intuitive analysis, reporting and management of risk.