Welcome to the future of SupTech

Winner of the Best Risk Management Initiative at the Central Banking Awards 2024, ORBS is a breakthrough in risk analytics for smarter, faster, more intuitive analysis, reporting and supervision.

It delivers a 360° understanding of market risk for financial institutions, regulatory authorities, supervisors, central banks and governments.

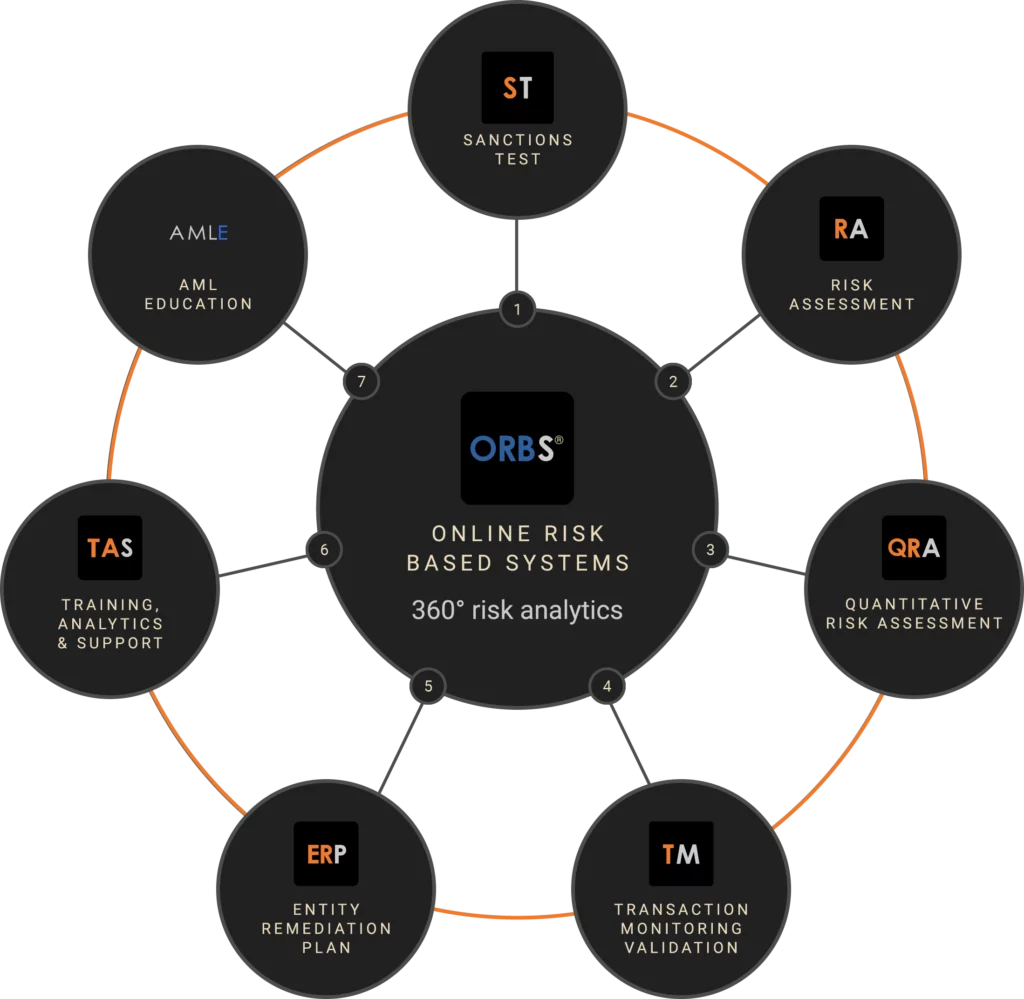

Functionality of ORBS

RISK analytics LIFE CYCLE

ORBS is an integral part of an organisation’s end-to-end risk process. Data flows into ORBS and the solution presents an entire market’s risk on a single screen for optimum oversight, understanding and decision making.

It supports the whole risk life cycle from sanctions testing and quantitative risk assessment, all the way through to remediation and education. It drives a holistic understanding of risk resulting in superior risk mitigation activities.

What sets ORBS apart?

the benefits

A visionary risk analytics solution, it’s changing the way financial institutions, regulatory authorities, supervisors, central banks and governments approach risk, bringing never-seen-before levels of transparency for improved reporting and supervision. Read about the many benefits below.

Automate

Save precious resource by letting ORBS take charge of process automation

Overview

View risk scores on a single screen for an entire market in the ORBS Risk Matrix

Bespoke

Configure your own risk RFI or use pre-made templates in ORBS to save time

Analytics

Benefit from analytical integration due to evenly applied risk methodologies

Scalability

ORBS is built with scalability in mind for higher numbers of entities

Investigate

Further investigate risk in your market by implementing follow-on RFIs

Award-winning

risk management solution

Best risk management initiative

ORBS was launched in 2023 and gained rapid recognition, winning Best Risk Management Initiative the following year at the Central Banking Awards in 2024. The prestigious award recognised that ORBS has helped, and continues to help, countries on the Financial Action Task Force list of Jurisdictions Under Increased Monitoring get removed from the “grey list”. Many other countries around the world are now introducing it into their regulatory risk strategy.

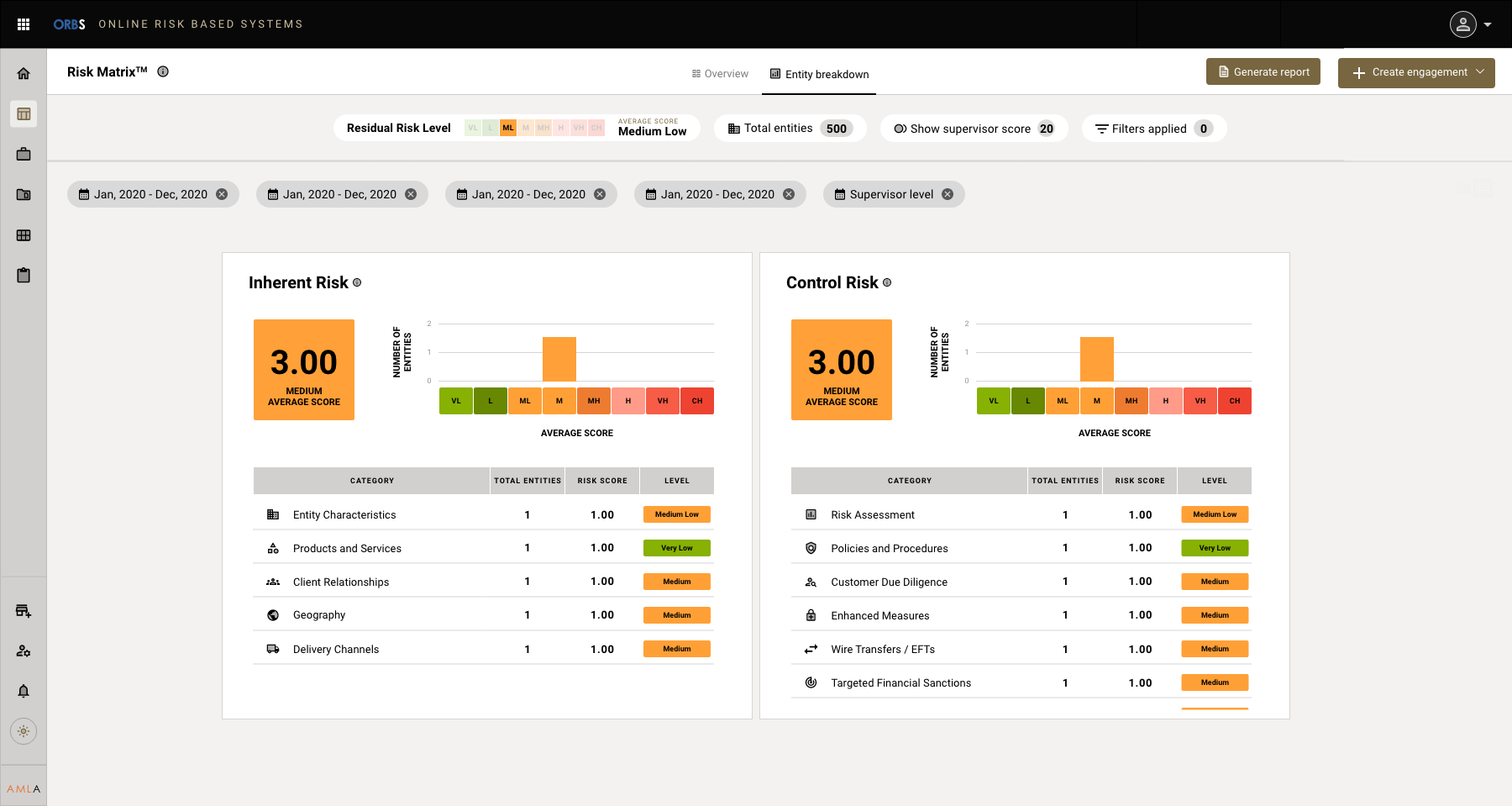

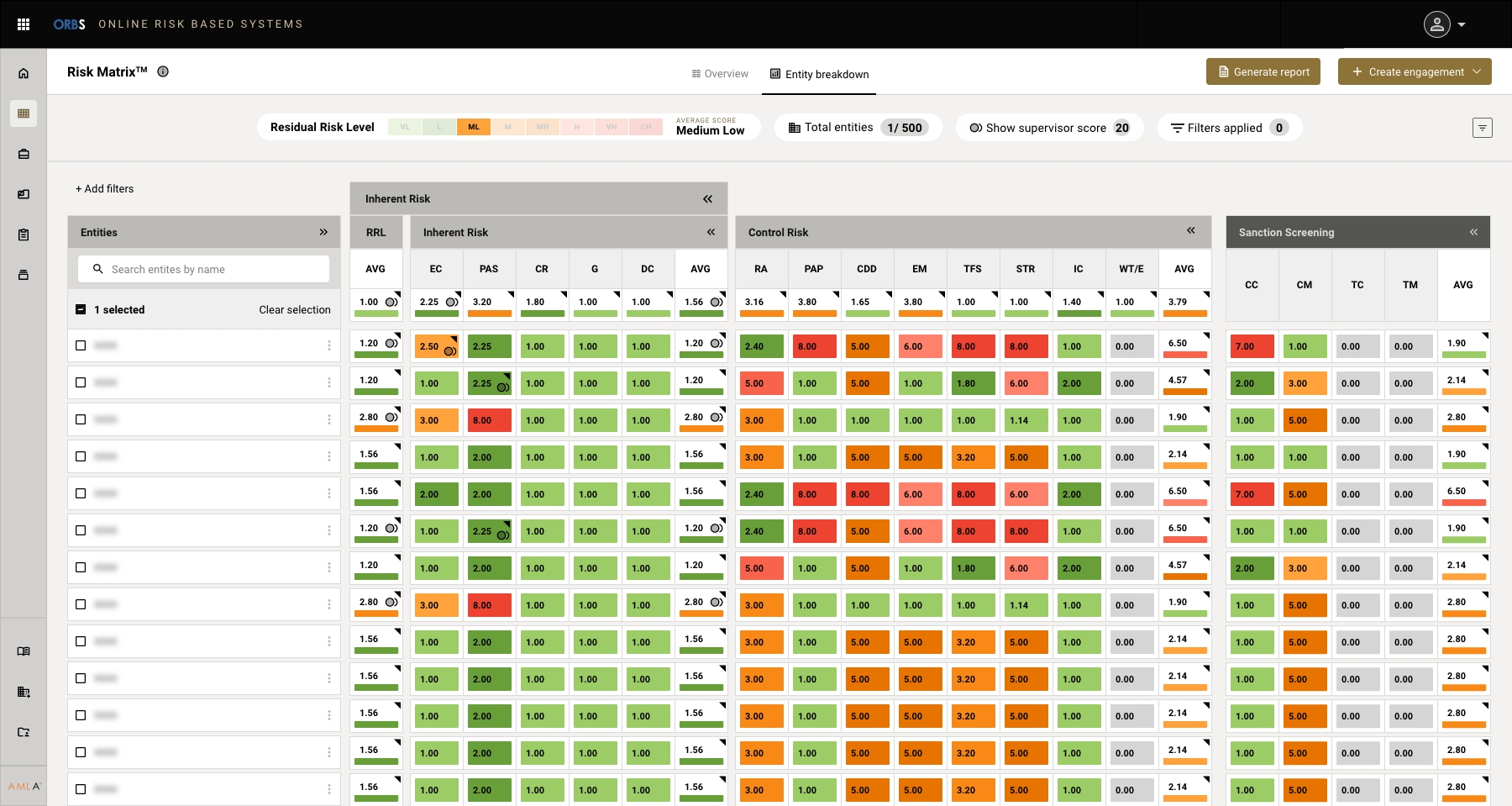

Oversight on a single screen

the ORBS Risk Matrix

The ORBS Risk Matrix presents accumulated market risk on a single screen to those needing clear, supervisory oversight. It provides an overall residual risk score as well as a detailed breakdown of specific risk for each entity. Sanction screening and transaction monitoring system testing and validation technologies feed into ORBS so that the Risk Matrix becomes the ultimate consolidated risk analysis screen.

ORBS gathers information efficiently and assesses risk effectively, supports on and offsite mitigation activities, tracks action plans to completion and reports on the data points required to evidence the effectiveness of the supervisory framework. Implementation transforms the transparency of residual risk and ensures that vital resource is deployed where it is needed most.

Overview

Entity breakdown

What our partners have to say about us

“Ten years of work has been done in six months.”

— DNFBP Supervisor